Charge it!?

Believe it or not, credit is sometimes a better choice than debit. Here's why, along with six commandments for using credit responsibly

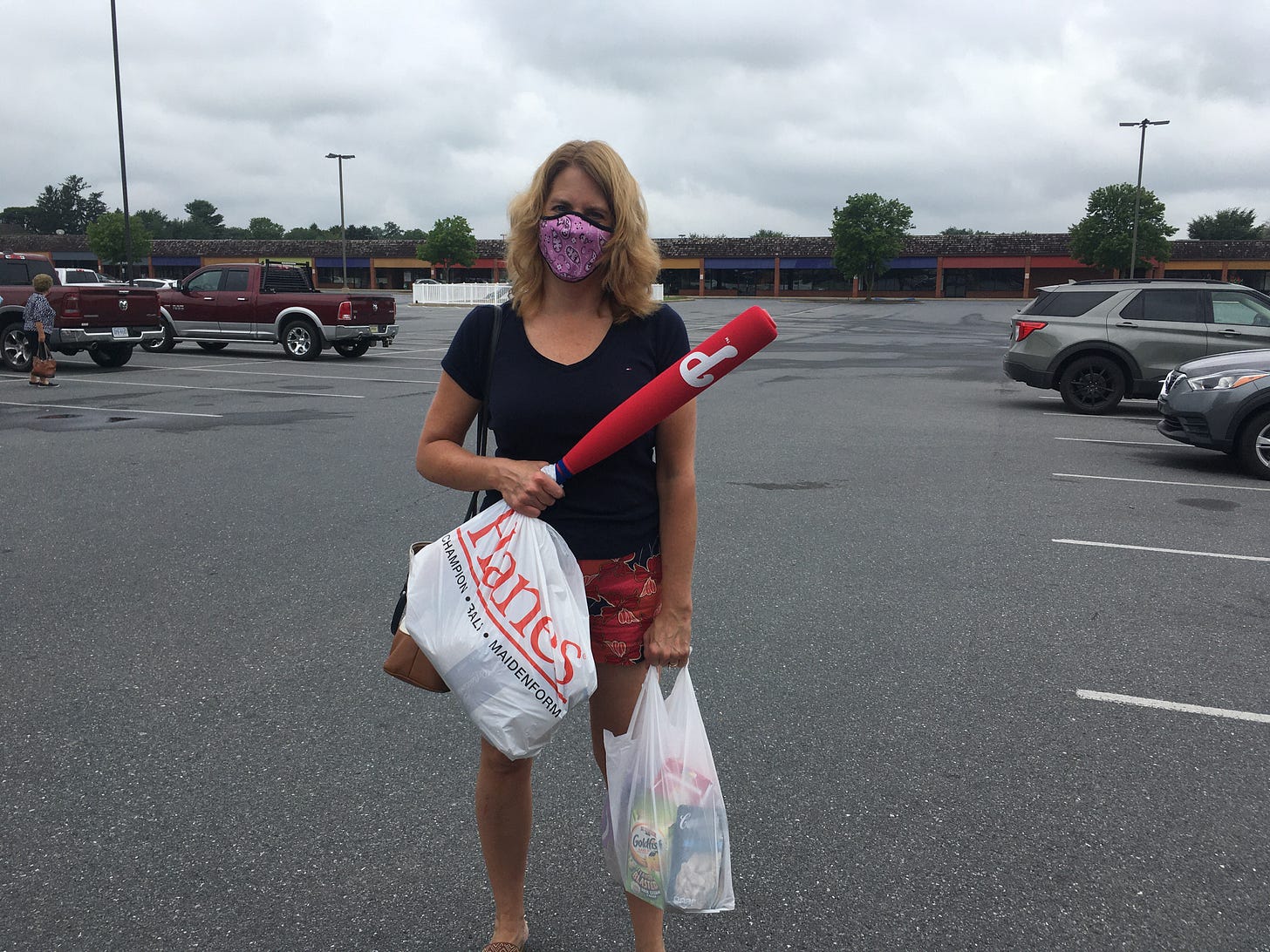

Flintstones. Meet the Flintstones. They’re the modern stone-age family who starred with their friends, the Rubbles, in the first animated series ever to air on prime-time TV. That’s Wilma Flintstone on the left and Betty Rubble on the right. They both look stoked because they’re about to take themselves on one of those shopping sprees they were known for. If you click the image, you’ll hear their battle cry— ”Charge it!”

Binge-watch Flintstone reruns, and you’ll soon notice that its creators were masters at incorporating a little social commentary into this cartoon meant for grown-ups. Back in the 1960s (which probably seems like the Stone Age to my Gen Z readers haha), credit cards were a relatively new feature of middle-class life. At the time, old-school thinkers believed using credit cards was a dangerous habit.

For instance, my grandmother, who’d lived through the Great Depression, believed if you couldn’t pay for something in cash, you had no business buying it. The fact that Wilma and Betty became known for running off with credit cards in hand to buy things they didn’t need, screaming “charge it” makes me wonder if maybe some of The Flintstone creators agreed. At least the creators weren’t misogynists–Wilma and Betty weren’t the only charge-happy shoppers; in another episode, Fred and Barney were off, plastic in hand, to treat themselves to new bowling balls.

Credit cards have become such a ubiquitous feature of everyday American life since The Flintstones first aired that I was surprised recently to see stats showing that Gen Z isn’t nearly as attached to credit cards as Gen X or Millennials.

The consulting firm EY reports that while 69% of Gen Z use a debit card at least once a week, only 39% say they frequently use credit cards. Experts say that some of this reluctance to use credit cards was sparked by Gen Z seeing their parents or others in their orbit struggle with credit card debt.

Let me first say kudos to Gen Z for striving to handle their finances responsibly.

And then let me next say something maybe you didn’t expect to hear–having at least one credit card and using it responsibly is an essential life skill.

So, let’s first talk about why young adults should routinely use credit cards, and then let’s discuss how to use credit cards responsibly in a way that’s beneficial to you.

You need to “charge it” to develop a credit history

If you’re relying on using your debit card so you’re not tempted to spend beyond your means, good for you for being so self-aware about temptations towards risky behavior.

But the reality is it’s wise to use a credit card judiciously. Building a credit history and establishing a solid credit score will help ease your way through adulthood.

Good credit helps you secure an apartment lease. It enables you to avoid having to put down a deposit when you sign up for utility service. Some employers even check credit reports to get a sense of how responsible you are.

And a credit history will be essential when you eventually apply for a mortgage or a car loan. Lenders want to see that you have the discipline to pay what you owe on time.

You can still use your debit card for purchases in places where you don’t want to go overboard with your spending, like Abercrombie or Sephora. But when you’re making purchases like a new sofa or even your weekly groceries, those could be chances to demonstrate that you can use credit responsibly and pay your bills on time.

How to find the best credit card

Nerdwallet has done a lot of the heavy lifting to help you evaluate various credit cards in their Best Credit Cards guide, though it’s on you to weigh which card is the best fit for you.

You should take full advantage of the perks and rewards that credit card companies offer to entice you to become their customer. There is no reason not to have your bags fly free on your favorite airline, earn points that will help you get a free hotel room, or let the credit card company pick up the tab for your rental car insurance.

There’s also no harm in earning a “cashback bonus” based on your spending as long as you’re not canceling it out by carrying a balance month to month. Just be careful not to fall into the trap of justifying purchases because “the more I spend, the more I earn.”

Bankrate recently published a rundown of the best credit card rewards programs in 2024, making it easier to shop for a credit card most likely to benefit you.

Be aware that you may not qualify for a traditional credit card if you lack a credit history. You may first have to get a secured credit card that requires a deposit equal to your credit line. Then, after several months of positive payment history, you can graduate to a credit card with a larger, unsecured credit limit.

Once you have a credit card riding around in your wallet, if you observe six credit card commandments, you should have a happy, healthy financial life:

I. Thou shalt remember that the credit card company is not thy benevolent rich uncle

Credit card companies are in business to make money off the money they are, in effect, loaning you.

A credit card company will establish a credit limit you can’t exceed without incurring additional fees or triggering a declined transaction. But in general, they will be thrilled to enable you to buy things today that you may not truly be able to afford.

If you can’t really afford the tab you run up on a credit card, you’ll end up carrying a balance, and you won’t be alone. According to the information services company Experian, Gen Z has an average credit card balance of $3,262.

Your credit card company is not looking out for your financial best interests; that’s on you. But if you follow the other credit card commandments, you can use credit cards in a way that benefits you.

II. Thou shalt strive to pay thy credit card balance off every month

The healthiest way to think of a credit card is as a form of payment–not as a “fixer” to fill the gap between what you want and what you can genuinely afford.

Most of the time, your credit card should serve as a convenient form of payment, with you paying off whatever the credit card balance is every month.

You won't be charged interest if you pay off your entire credit balance before the due date. However, any amount you don’t pay during the grace period will start accruing interest charges and continue to snowball until you pay it off.

If you want to see how quickly interest charges can add up, take Nerdwallet’s “How interest adds up over time” calculator for a spin.

Be aware that making only the minimum payment will cost you dearly. For instance, if I decided to make only the minimum payment of $40 on the $1,164 balance on my latest credit card statement–and I didn’t make any additional charges using the card–it would take me 3 years to pay off the balance, and I’d pay $395 in interest charges.

You don’t need to calculate what it will cost you to make only the minimum payment on your particular balance–credit card companies are required by law to let you know how long it will take you to pay off your current balance if you make no further charges and pay only the minimum amount due each month. If you’re tempted to pay only the minimum balance, reviewing these stats may help you resist.

III. Thou shalt always pay thy credit card bill on time

If you are living within your means, you should be able to pay your credit card balance in full each month. But even if you can’t pay the entire balance, always make at least your minimum payment (and preferably more than that) by the due date.

If your payment is late, expect to be charged a late fee. And remember that if it is more than a few days late, it can be reported as a delinquency, which will hurt your credit score.

IV. Thou shalt review thy credit card statement monthly

Whether you review it once a month when the bill is issued or monitor your charges more frequently, you need to keep an eye out for fraud. If you spy anything strange, report it immediately to the credit card company.

Don’t ignore tiny unauthorized charges. Though reporting a couple of pennies charged may not seem worth your time, keep in mind that sometimes crooks test your card like this before they attempt a bigger scam.

It’s enough to have to fund your own purchases; you don’t want to end up paying for somebody else’s too.

V. When paying for a larger purchase over time, thou shalt do so as economically as possible

We all make larger purchases that we can’t pay off in one month. Ideally, when you’re planning to purchase something like a piece of furniture, you’ll set money aside in the months leading up to that purchase and then make the purchase.

But sometimes appliances break when you least expect it, or you end up with a large car repair bill that you hadn’t anticipated. So you need to “borrow” a little money to pay the bill to cover what’s not in your savings account.

For something like the unexpected car repair bill, hopefully you have begun and been contributing to a rainy-day fund that you can draw on. But if you don’t have enough funds to cover it, your best option is to pay the bill using whatever credit card you have with the lowest interest rate.

If you don’t currently have a credit card with a favorable interest rate, now is the time to find one for yourself–as they say, dig your well before you’re thirsty. Bankrate has a guide to the best low-interest credit cards.

Sometimes, when you purchase something like an appliance using a retailer's credit card, you can get a “no payment for three months” deal. It’s okay to take full advantage of such an offer as long as you are mindful that your credit card will likely be charged a hefty interest rate once the promotional period is over.

So take the offer, but then see what other expenses you can trim from your budget so that you pay off that credit card before the hefty interest charges kick in. Or figure out if there’s a way to shift the balance that you owe at the end of the promo period to a credit card with a lower interest rate.

VI. Thou shalt commit to using credit cards responsibly and getting thyself back on track when necessary

Credit cards are like most things in life–using them is fine as long as you do so responsibly and in moderation.

The key is to use credit cards in a way that contributes to your overall, long-term well-being. You don’t want to overdo it and end up feeling like an indentured servant who will never be able to pay off their credit card balance.

If you carry a credit card balance, don’t despair and start believing it’s impossible to get things under control. This Nerdwallet article on how to get out of credit card debt in five steps is a good place to start.

Now, go forth responsibly, and just like Wilma and Betty said, “Charge it!”

Author Rainesford Stauffer noticed that while young adults are told that they can be anything, sometimes it feels like so much effort is spent living up to the ideal of the person you could be that the person you become is an afterthought. Stauffer notes, “This pressure to know what your ‘best life’ entails, and how to create it in young adulthood, felt worthy of a closer look to see where it stems from, how it shapes young people, and what systems and power structures enable it.”

Stauffer says she, “thought about the steadiness of a partner and community when I was supposed to feel confident and proud to go it alone. A sense of self that wasn’t tethered to what I achieved or who I pleased. Framed photos of people I love in a home and a dresser in my bedroom, signs of staying instead of looking toward the horizon of the next new place.”

Stauffer wondered why there is this pressure to have your life fully figured out by the time you make it to your mid-twenties. She wondered, “Why the averageness of coming of age wasn’t talked about as much as achieving your wildest dreams.” Thus she set out to explore these themes in An Ordinary Age.

Look for more excerpts from An Ordinary Age next issue.

In the olden days, moms used to clip newspaper articles for their kids if they thought it was something they needed to know. I’m watching for things you might have missed that may be helpful to you.

This week’s clips:

Want to wield your credit card even more like a boss? Nerdwallet shares seven credit card tips everyone should know.

Sick of dating apps? USA Today reports that speed dating is making a comeback and offers some tips for making the most of it.

How do you stay hopeful and fight for what matters when the world seems toxic? Author John Pavlovitz offers a roadmap in Maria Shriver’s Sunday Paper.

Charge It! One of our favorite phrases!

Excellent advice:)

This is such great advice as always!