How to get your financial life together in your 20s

12 tips for building financial stability without overwhelming yourself

Since it’s January, you’re bound to come across someone, or multiple someones, urging you to get your financial affairs in order as one of your New Year’s resolutions. Maybe you’re tempted to avoid the subject because it’s scary and overwhelming. But deep down, you know that sooner or later you need to make sure you’re building a firm financial foundation for your life.

Though I’m not a financial advisor, I was once a 20-something, just like you, who had to figure it all out. So today, in the interest of helping you find your way toward fiscal sanity without being overwhelmed, I’d like to share my journey and some basic principles that may help you get a handle on your financial affairs.

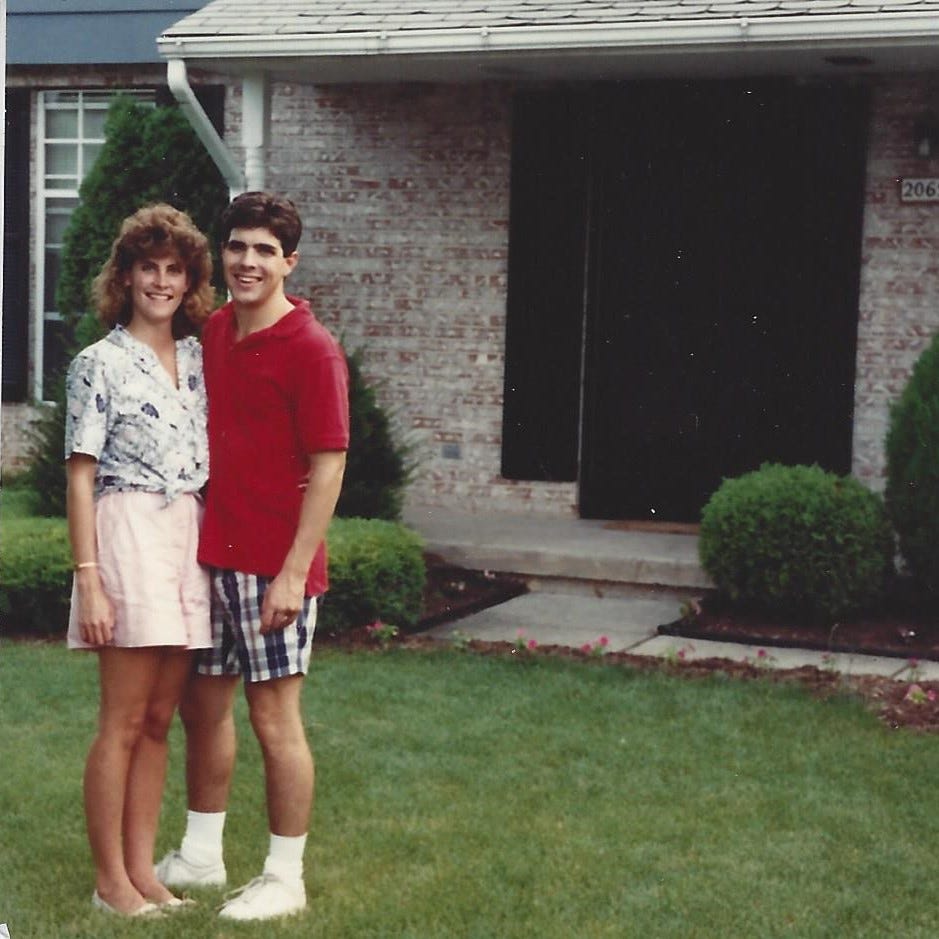

I was 24 when I was launched into the brave new world of being financially responsible for myself. I’d lived at home after college while I went to grad school, so I’d had a brief reprieve from dealing with the real world in its entirety. But then I graduated in December, started my first full-time job in January, bought a house with my soon-to-be husband in March, and got married in May.

During those months, I was so busy assembling my big-girl life that I didn’t have time to ponder the gravity of my new reality. But once we returned from the honeymoon, it hit me–though I had a partner with me for better or worse, I was now in charge of my own financial destiny.

Although we hadn’t stretched beyond our means to buy our house (the bank wouldn’t have let that happen), we did have to be careful with our money. Fortunately, many people had given us cash gifts for our wedding, which gave us a bit of a cushion. But with a mortgage payment and two car loans, the days of only needing to fund clothes shopping, entertainment, and personal expenses were over for good.

Since I had only ever lived with my parents or in a dorm, I spent those first few months amazed at how many bills kept arriving in the mail—for the phone, the electricity, the water, the trash, the sewer, etc. It wasn’t like I didn’t know we’d have the expenses or how we’d pay them. I was just stunned by the regularity with which the bills kept coming.

Some days, it seemed like I’d no sooner pay one bill and another one would appear. Luckily, my husband was a veteran of two apartment leases, so he was there to assure me that it was all perfectly normal.

We’d both grown up in families that had always been disciplined about money, so at least we were on the same page about meeting our obligations. In fact, once we built a little savings cushion, we could probably live relatively well as a double-income no-kids couple. Presumably our salaries would increase over time.

But deep down, I knew we had to have an eye on the big picture because we had some long-term goals too. For one thing, we wanted to travel before we had kids–a trip to Europe was definitely on our bucket list. My husband knew that grad school would be part of his future sooner or later. And even though retirement seemed a ridiculously long time off, it was hard to ignore the financial planning gurus’ warnings to start contributing to a 401K. (Catch up on the basics of what you need to know about a 401K here.)

Plus becoming a homeowner came with its own wish list. We wanted to redecorate the house to make it more our style. Some rooms were missing furniture or filled with hand-me-downs that weren’t what I had in mind for the long haul.

And then there were dreams of things that were years away, but that we couldn’t entirely ignore if we eventually wanted to see them happen. While we were delighted to have a house of our own, we both imagined living in a charming older house large enough to accommodate a couple of kids someday. And though I didn’t think much about it so as not to totally overwhelm myself, having a family was surely going to involve a whole other series of expenses.

Clearly we had to come up with a strategy. We didn’t create a financial master plan (maybe some people do, but I didn’t know anyone in their 20s who did). But we began educating ourselves on the topics we needed to understand so we could develop principles for dealing with our finances.

If you’re ready to start or are in the process of getting your own financial house in order, here are 12 guiding principles we followed that might help.

Get a handle on your expenses and develop a system

Initially, I was tossing bills willy-nilly into an empty kitchen drawer. It didn’t take long to realize that a filing system was in order, not just because I’d eventually want that kitchen drawer back but also because I needed a better handle on our finances.

It got easier to make peace with bills being a routine part of life once I got my arms around our expenses, when they occurred, and how the outflows matched up with the paychecks landing in our bank account.

Even if most of your financial transactions are online and you’re not dealing with paper, you need a system to ensure bills are paid on time, so you can easily retrace your steps when necessary, and so you have an overall picture of your obligations.

It sounds basic, but understanding how your expenses match your available funds is essential.

Make a budget

When you get right down to it, the essence of any financial plan is just math. Money comes into your bank account, and it goes out. If you don’t have a handle on the figures, you’re in trouble. As management guru Peter Drucker famously said, “If you can't measure it, you can't manage it.”

Your budget doesn’t have to be complicated. Calculating the revenue should be easy if you’re receiving a steady paycheck. As for the expenses, start by filling in what you know.

As with most things in the 21st century, apps are available to help you track your spending, and most credit cards can help you analyze your spending by category.

Once you can see it all in black and white, group the expenses into three buckets–fixed (those you can’t change easily), semi-discretionary (for those you have some control over), and discretionary (for those you have complete control of). This will make it easier for you to identify those expenses you can trim if you need to or want to.

It can feel a little harder to trim semi-discretionary expenses like, for instance, those associated with a friend’s wedding. But it’s not impossible—here are some ideas.

Identify longer-term goals and hang a price tag on them

How do you get to any destination if you don’t know where you want to go? I know the phrase “longer-term goals” wigs some people out. But it shouldn’t. A long-term goal doesn’t mean that all of the details for what you want are sketched in or that you know precisely how you will achieve it. But it’s the starting point for developing a plan.

For instance, we knew we wanted to travel to Europe. Identifying the goal helped frame a plan. We read about potential destinations. We drafted an itinerary. Then we priced flights and hotel stays. This gave us a number and helped us calculate when we’d have enough money saved to make the trip. (Read all about what we got wrong on that trip here.)

Later on, we considered a trip to Australia and New Zealand. But when I hung a price tag on that trip, it became clear we wouldn’t be able to take it and still have enough money for a down payment on a larger house. So we deferred that dream.

It would be nice if you could do everything you want, but sometimes you have to make choices. You may not be able to achieve all of your long-term goals as soon as you would like (I’m still hoping we get to Australia someday), but the price tag exercise can help you reach some of them.

Don’t spend all the money you earn

How much of your earnings should go into savings is a larger question that I won’t get into. But intuitively, you know some of your earnings should go into savings.

For one thing, you need a rainy-day fund to cover emergencies like losing your job and large, unexpected bills (most experts suggest having enough to cover three to six months’ worth of expenses). For another, you’ll need to accumulate funds to meet your longer-term goals, like buying a house or taking a big trip.

Delay gratification sometimes

Especially for those expenses that are discretionary or semi-discretionary, it’s wise to assess whether whatever you spend your money on delivers enough value for you.

For instance, while it’s fun to go out to a nice restaurant for dinner, or sometimes it’s more convenient to hit a drive-through for dinner, those are more expensive ways of feeding yourself. With so many things on our wish list in those early years, we limited how often we ate out. I was willing to sacrifice the pleasure of not having to cook a meal so we’d have more money in our savings account to fund travel or tackle a home improvement project.

We also recognized that it might take a few years to furnish our house the way we ultimately wanted. So we lived with empty rooms and hand-me-down furnishings for a while. It was just as well because it took us some time to figure out what we wanted anyway.

Trim expenses where you can

This is one of the most straightforward recommendations to make, though it takes some research on your part to make it happen. Sometimes you can save money by simply shopping around, whether for phone service or car insurance. Seeking out deals makes your money go further.

Don’t carry a balance on your credit cards

We tried to think of credit cards as a convenient form of payment rather than as a “rich uncle” ready to chip in whenever we wanted something. We didn’t want to pay interest on routine purchases, so we paid our credit card bills in full every month.

These days credit cards make it extremely easy to buy almost anything you want as soon as you want it. However, you should recognize that if you don’t pay your credit card bill in full every month, you’re paying a premium for whatever you buy–be it groceries or a pair of jeans.

The average interest rate on a credit card right now is 24%. So if you carry a balance on your credit card, every $100 you spend costs you $124. Check your monthly statement, and you’ll see stats on how long it will take you to pay off your current balance if you only make the minimum payment and how much it will cost you in interest if you carry your balance that long. Buckle your seatbelt because those may be sobering numbers. But better to see it now than to spend all that extra money without recognizing it.

Credit cards can serve you well if you use them responsibly. Check out my deeper dive for details on how to do so.

For larger purchases, save for a down payment and look for the most economical way to pay for it over time

Most people pay for items with larger price tags (furniture, appliances, cars) over time. But whenever you finance a purchase, you still should have a repayment plan in mind that minimizes your borrowing time.

Our dining room was empty for the first two and a half years we lived in our house. As much as I longed for the dining room set that we fell in love with, for months we contented ourselves with occasional visits to the furniture store to admire it while we saved.

Retailers often offer deals that allow you to take delivery and make no payments, or at least not pay any interest, for six months or a year. This provides affordable payments and a good running start toward paying off large purchases without incurring a lot of interest charges.

Look for opportunities to increase inflows

Though most of the attention for a household budget is typically trained on expenses, don’t forget there’s always the option of trying to increase revenue too. Once you have some job experience, keep an eye out for promotion opportunities that will allow you to cash in on the skills you’ve acquired. Or consider if there’s a side hustle that would allow you to earn some extra money.

Do some of the work yourself

Sometimes you must pay somebody to perform services you can’t do yourself. For instance, we never handled our own plumbing or car repairs. But we turned painting and replacing the bathroom tile into do-it-yourself projects. And though I did not love cleaning bathrooms or cleaning the house in general, we did that ourselves too.

You can pay someone to perform almost any service you can think of instead of doing it yourself. But it’s wise to consider whether paying someone to deliver fast food to your door or to give you a manicure is worth it to you when you could do those things yourself.

Put the money you’re saving someplace where it earns money for you

You may not have a lot of extra funds. But hopefully you have or are building that rainy day savings fund you’re supposed to have. There’s no reason that this money can’t be working for you. Look for high-yield savings accounts or no-penalty-for-early-withdrawal CDs to stash these funds in.

And even when it comes to buying things, you can cash in on some perks with a credit card that pays you cash back at the end of the year or that earns you flight miles or hotel nights.

Don’t rely upon things that cost money to fill you up

Who among us hasn’t purchased something–even something as simple as clothing–because we believe it will make us feel better about ourselves? But if I had one wish for you, it’s that you discover the truth in the song “The Best Things in Life Are Free” sooner rather than later.

The most satisfying experiences in your life will come about via people, not through stuff. And the sooner you discover this, you’ll be happier and have more money in your bank account.

Brilliant advice, as always. Now if you could just let me know how I persuade my 20 year old to read it... ha! Happy New Year to you x