Yes it is expensive to buy a house

The 411 on homeownership, why it's worth it, and how you can prepare

That’s me looking gleeful and somewhat dazed by all of the zeroes I’d just seen on all the papers we’d signed at settlement for our first home sweet home. My soon-to-be husband and I had just purchased a three-bedroom circa-1978 colonial that wasn't what we originally had in mind when we started house-hunting. But as Mick Jagger once sang, though you can’t always get what you want, you often find you get what you need.

The whole process of buying a house had felt like a semester-long course that we needed to complete in order to become full-fledged grown-ups. Since houses weren’t listed online back then, we had spent hours thumbing through the multiple-listing books at our real estate agent’s office. Then we’d tour the ones that seemed to have potential. (No photos of the interiors in those days so scouting in person was the only way to see it.) Like Goldilocks, we spent a lot of time rejecting things that weren’t quite right for one reason or another.

When we first started looking at the real estate listings, it was kind of jarring to imagine how we could afford to buy something that cost more than a hundred thousand dollars.

One of the first things our real estate agent did was figure out the size of house we could afford to buy based on our monthly income at the time. That benchmark ensured we only looked at houses that fit our budget. Then came the mental process of making tradeoffs.

We had desperately wanted a charming old house. But the only old houses we could afford were fixer-uppers or small or in less than ideal locations. So we decided to defer our old house dream, and choose a newer house that wouldn’t need as much work. Though it didn’t have as much character as we would have liked, it had a deck and a great backyard and was near a commuter rail line and our parents.

We ended up spending $151,000. It probably seems like a real bargain to you, but at the time, it seemed like a lot of money to me. Like most people, buying a house required being disciplined about saving money. In the months leading up to our house-hunt, we saved as much as we could from our salaries. Though this didn’t amount to a boatload of income, we both lived at home, which freed us from rent and living expenses, and we were careful about how much we spent on entertainment or clothes.

I was also fortunate that my mom had always been disciplined about putting any birthday, Christmas, and other gift monies bestowed on me into CDs, which created a tidy little dowry to put towards a house. In the months leading up to our house-hunt, Manus and I also saved as much as we could from his salary, my summer internship, and the stipend from my graduate assistantship. Though this didn’t amount to a boatload of income, living at home freed us from rent and living expenses, and we were careful about how much we spent on entertainment or clothes.

We soon discovered that the house came with a bonus feature–it had the magical power to transform us into grown-ass adults—all of a sudden we were standing in the aisle of a Home Depot on a Friday night instead of out with our friends. But there’s something special about having a home sweet starter home of your very own that you can remake anyway you like.

Why buy a house? It’s an asset that will appreciate and be a place to live

Unlike a rent payment, a portion of every monthly mortgage payment goes towards your ownership stake in the home. You are gradually buying a house over 30 years (or whatever timeframe your mortgage is), and in all likelihood, the value of your house will appreciate over time so that amount will end up being part of your ownership stake too. So at least now the money you’re putting out to keep a roof over your head will also be going towards something that will be yours to keep (or to later sell so that you can buy another house).

Buying a house is a whole new level of adulthood

You may already be used to shelling out rent every month to put a roof over your head, but homeownership does bring a higher level of financial responsibility. And once there’s no landlord to call when your toilet clogs or your refrigerator breaks, you will suddenly feel as if you’ve become your parents. But you weren’t really looking to be permanently Peter Pan, right?

Traditionally, a down payment is 20% of a house’s selling price, though some loans require as little as 3% down

We put 10% down on our first house, which meant our lender required us to carry private mortgage insurance (PMI), which helps insulate them from the greater risk you represent. (PMI adds an additional amount to your monthly mortgage payment.)

In general, the higher your down payment, the better the interest rate you can get. But there are multiple kinds of loans available to fit your situation. For instance, we found a loan that reduced the interest rate by a full percentage point in the first year, and then gradually stepped up in subsequent years. A down payment calculator can help you to evaluate your options.

When calculating how much money you need to buy a house, don’t forget to budget for closing costs

Closing costs are the fees and expenses you pay to finalize your mortgage. They include things like appraisal fees, title insurance, tax escrows, etc. They typically range from 2% to 6% of the loan amount.

Your monthly mortgage payment typically bundles in your real estate taxes and insurance premiums

In addition to the principal and interest payment going towards the price tag of your house, your monthly payment typically includes a prorated portion of your annual real estate taxes, your homeowner’s insurance, and PMI if it’s required.

Your lender will not let you bite off more than you can chew

The bank that’s loaning you the money to buy your house doesn’t want you to go so far out on a limb that you’re going to have trouble making your monthly payments. Most lenders won’t let you spend more than 25-28% of your gross monthly income on a mortgage payment. And they won’t allow you to spend more than 36% of your monthly income on debt payments.

Interest rates will affect your purchasing power, but keep in mind that you can refinance later if rates go down

I know it’s a bummer that rates on a 30-year fixed mortgage have been trending up lately and now average around 7.8%. (If it makes you feel any better, at the time we bought our house, rates were about 9.5%.) But keep in mind that a house is a purchase that you will be making over a period of 30 years. If rates go down significantly, you can always refinance your mortgage, which will result in a lower monthly payment.

It is normal to feel a little wigged out about buying something that costs this much money

With all of the signatures required on the official paperwork, you may feel like you’re signing your life away. No matter how much you prepare yourself, all the numbers with three zeroes after them on the settlement papers will be a little staggering. But presumably your salary will be going up over time, so gradually your mortgage payment will gradually claim a smaller percentage of your monthly income.

Even if you’re not ready to become a homeowner now, you can do things now to help yourself be fiscally fit when it’s time

Set a savings goal, polish your credit rating, and scrutinize your budget for ways to save. Having less discretionary funds for fun in your budget may take a little getting used to, but that’s the kind of tradeoff you have to make to become a homeowner. Nerdwallet has some tips for how to get started on saving.

Yes, houses do cost a lot of money. But you’ll get used to having a mortgage. And don’t forget there’s a huge upside–a home to call your very own. And possibly a whole new hobby of do-it-yourself projects. Maybe you can star in an episode of an HGTV show?

I’m curating a “Books of Wisdom” collection for you that covers all of the topics on the minds of people trying to get their lives together–love and relationships, career, finding meaning and purpose in life, and life hacks. In every issue, I’ll offer samples from the Book of the Month so that you can assess whether this book would be a good read for you.

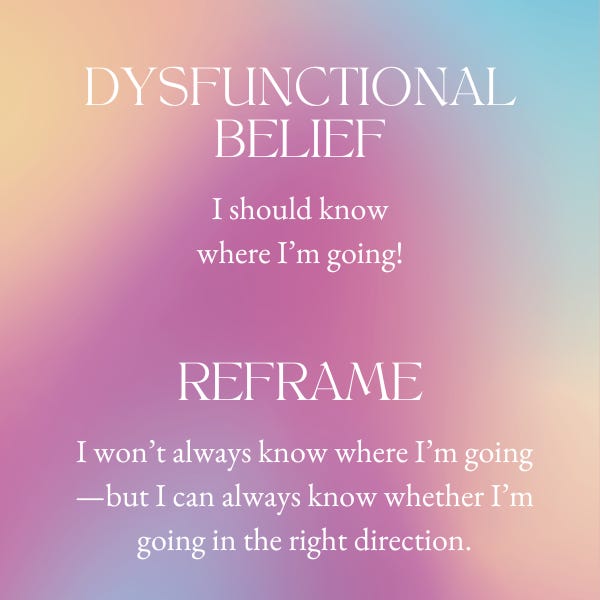

Burnett and Evans show how reframing is key to helping people get unstuck

The statistics are sobering:

Only 20% of young people age 12-26 have a clear vision of where they want to go, what they want to accomplish in life, and why

In the U.S., only 27% of college grads end up in a career related to their majors

According to Burnett and Evans, “The idea that what you major in is what you will do for the rest of your life is a dysfunctional belief that prevents people from designing the life they want.”

“In life design, we reframe a lot. The biggest reframe is that your life can’t be perfectly planned–there isn’t just one solution to your life, and that’s a good thing. There are many designs for your life, all filled with hope for the kind of creative and unfolding reality that makes life worth living into,” said Burnett and Evans.

According to Burnett and Evans, “The reframe for the question, ‘What do you want to be when you grow up?’ is this: ‘Who or what do you want to grow into?’ Life is all about growth and change…It’s not about answering the question once and for all and then it’s all done. Even those who checked a box for doctor, lawyer, or engineer. These are just vague directions on a life path. There are so many questions that persist at every step of the way. What people need is a process–a design process–for figuring out what they want, whom they want to grow into, and how to create a life they love.”

Stay tuned for more snippets from Designing Your Life this month.

In the olden days, moms used to clip articles from newspapers for their kids if they thought it was something they needed to know. I’ll be keeping an eye out for things that you might have missed that may be helpful to you.

A special collection of clips for the “homeowner curious”:

23 Things Every First-Time Homebuyer Should Know Sure HGTV has a vested interest in you binge-watching their programs, but their guide provides solid food for thought as you ponder taking the housing plunge.

The U.S. Department of Housing and Urban Development covers the basics about everything from shopping for a loan to making an offer at their Buying a Home page.

You’ve probably heard horror tales about how tricky it can be to find a house to buy these days. Consumer Reports’ How to Buy a Home in an Overheated Market gives you the lowdown.

Other clips:

Research indicates that perfectionism is on the rise among young adults. Take a quiz to find out What kind of perfectionist are you?

Fantasizing about turning your side hustle into something more? The Terminator himself, Arnold Schwarznegger, explains why to keep your day job while starting a business.

Feeling salty about how much you’re putting into a relationship compared to your partner, friend, or family member? Psychologist Yael Schonbrun explains how scorekeeping harms relationships.